เกี่ยวกับเรา

- เราคือใคร

- ทำไมจึงเลือกฟิวชั่น

- รางวัลที่เราได้รับ

- บทความ

- ใบอนุญาต และระเบียบข้อบังคับ

- เอกสารระบุตัวตน

Fusion Markets

Legal

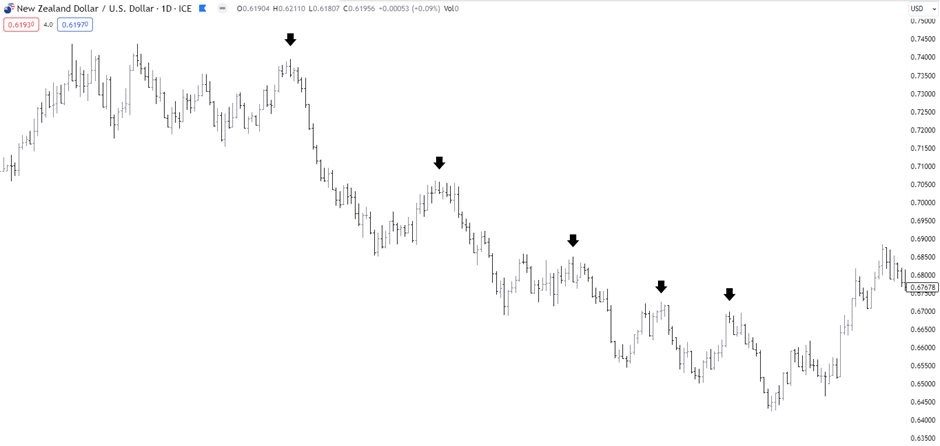

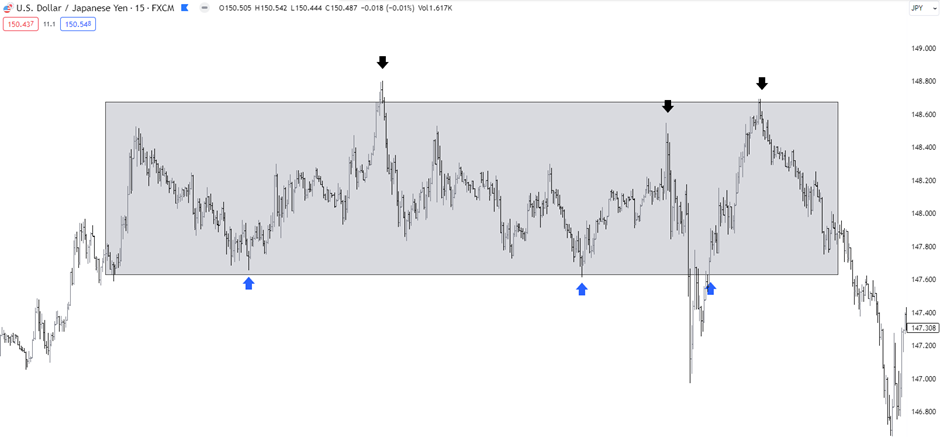

การเทรด

แพลตฟอร์มและเครื่องมือ

- MetaTrader 4

- MT4 Mobile Apps

- WebTrader for MT4

- MetaTrader 5

- TradingView

- cTrader Desktop

- cTrader Mobile

- cTrader Web

- Multi Account Manager

- DupliTrade

MetaTrader 4/5

TradingView

cTrader

More Platforms

ร่วมงานกับเรา

ช่วยเหลือ

- ติดต่อเรา

- คำถามที่พบบ่อย

ช่วยเหลือ